Llc Equity Section Of Balance Sheet - Unlike corporations, llcs should not report equity contributed by members separately from earned equity. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. If the total amount of members' equity. After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the.

Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. If the total amount of members' equity. Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. Unlike corporations, llcs should not report equity contributed by members separately from earned equity.

After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. Unlike corporations, llcs should not report equity contributed by members separately from earned equity. Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. If the total amount of members' equity. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets.

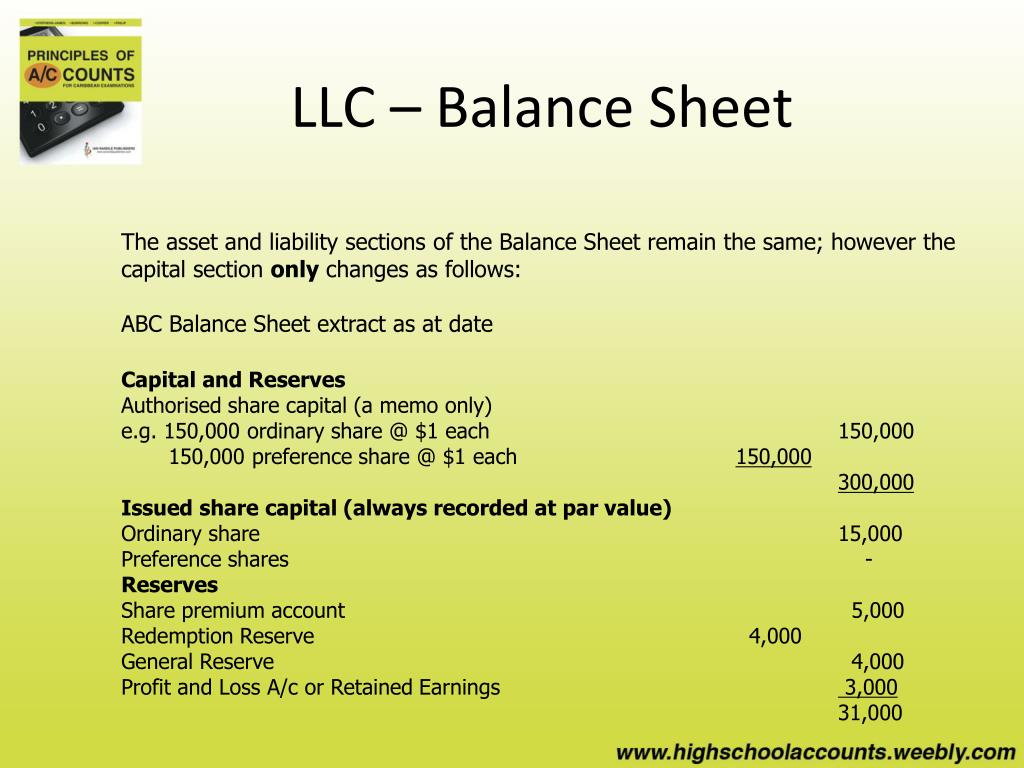

Chap002 libby power

Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. Unlike corporations, llcs should not report equity contributed by members separately from earned equity. After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. The equity section of the balance sheet should be titled members’ equity.

PPT Shareholders’ Equity PowerPoint Presentation, free download ID

Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. If the total amount of members' equity. Unlike corporations, llcs should not report equity contributed by members separately from earned equity. Partnerships and limited liability companies.

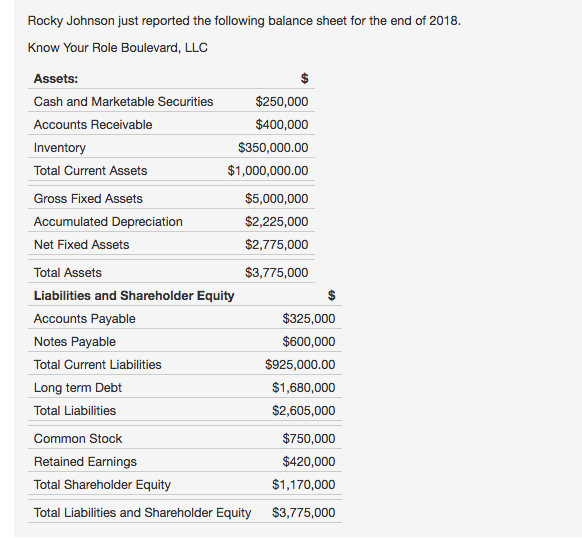

Solved One Llc

The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. If the total amount of members' equity. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets..

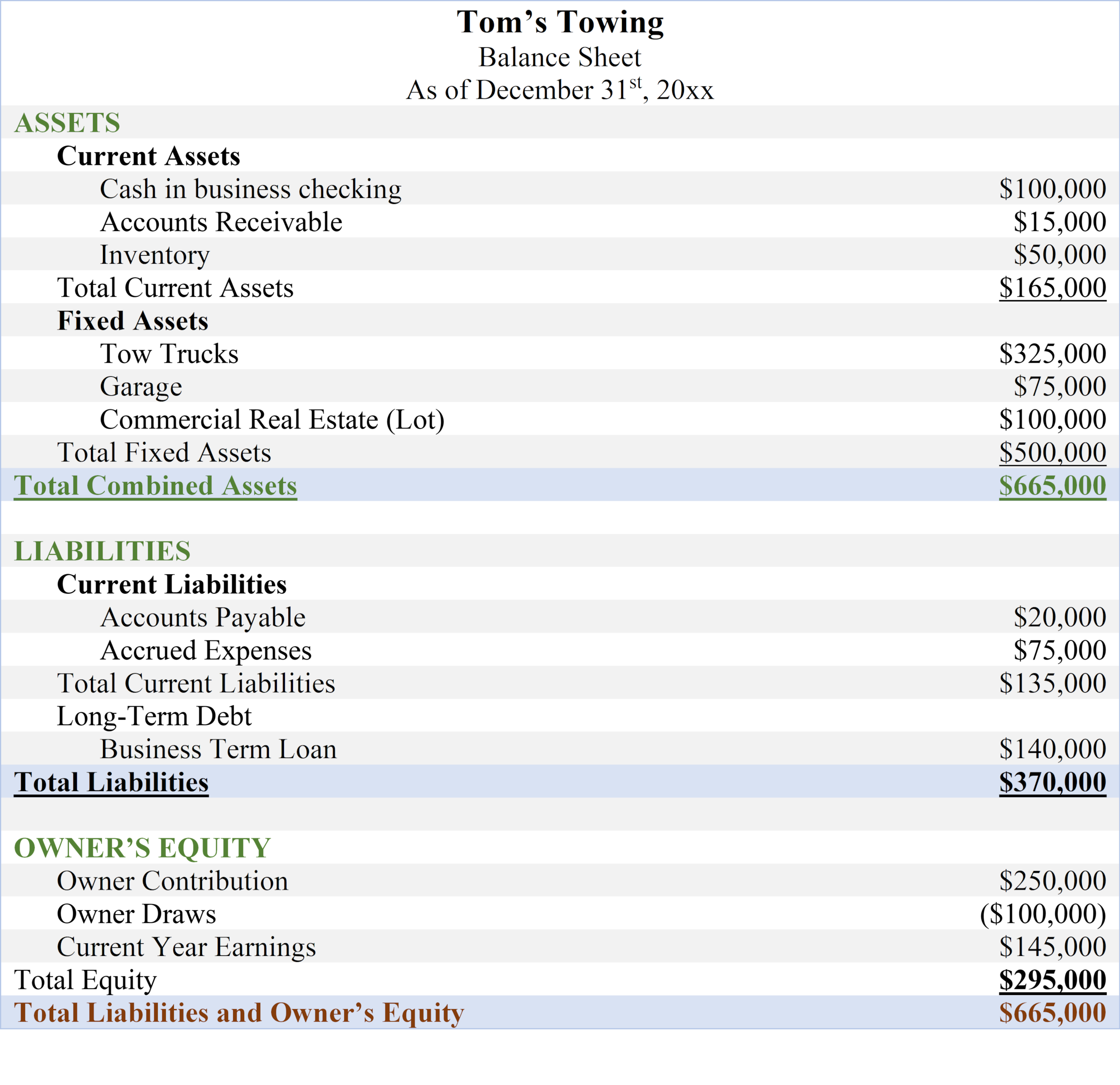

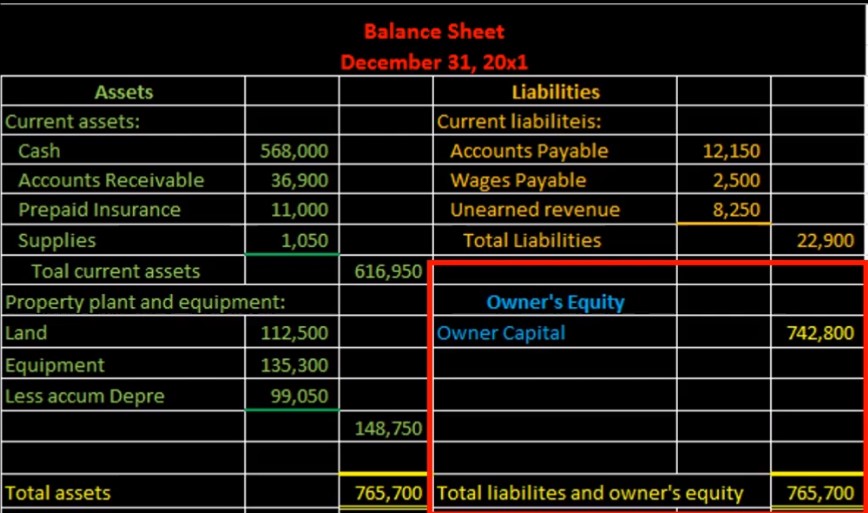

Balance Sheet Liabilities and Member's Equity

The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from.

PPT Chapter 16 LIMITED LIABILITY COMPANIES (LLC) PowerPoint

If the total amount of members' equity. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. Unlike corporations, llcs should not report equity.

Solved Following Is The Shareholders' Equity Section Of W...

Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. If the total amount of members' equity. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. The equity section of the balance sheet should be titled members’ equity (llcs).

What Is Owner's Equity? The Essential Guide 2025

Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. If the total amount of members' equity..

Balance Sheet Equity Section Creation from Trial Balance 15

Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the. If the total amount of.

Llc Balance Sheet Example amulette

Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. If the total amount of members' equity. After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially.

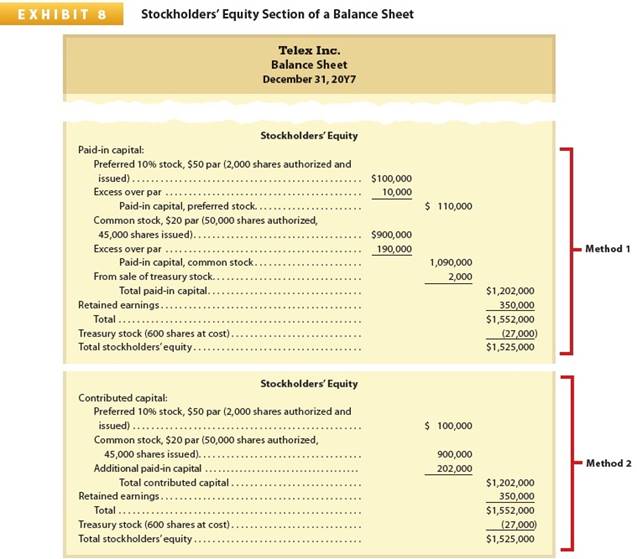

(Solved) Stockholders' Equity Section Of A Balance Sheet Telex Inc

Unlike corporations, llcs should not report equity contributed by members separately from earned equity. Partnerships and limited liability companies (llc’s) use capital accounts instead of stock (corporations) or equity (sole. If the total amount of members' equity. Equity reflects the owners’ residual interest in the company after liabilities are subtracted from assets. Equity reflects the residual interest in the assets.

Equity Reflects The Owners’ Residual Interest In The Company After Liabilities Are Subtracted From Assets.

Unlike corporations, llcs should not report equity contributed by members separately from earned equity. The equity section of the balance sheet should be titled members’ equity (llcs) or owners’ equity (partnerships) in contrast to shareholders’ or. If the total amount of members' equity. Equity reflects the residual interest in the assets of the llc after deducting its liabilities and is essentially the ownership stake held by the.

Partnerships And Limited Liability Companies (Llc’s) Use Capital Accounts Instead Of Stock (Corporations) Or Equity (Sole.

After reviewing the characteristics and equity reporting of these business forms, the chapter focuses on partnerships and limited liability.