Depreciation On A Balance Sheet - This gives a more realistic picture of what your assets are worth. The cost for each year you own the asset becomes a. It lowers the value of your assets through accumulated depreciation. Thus, depreciation is a process of allocation and not valuation. How does depreciation affect my balance sheet? Here are the different depreciation methods and how. Learn why depreciation is an estimated expense that does. The expenditure on the purchase of machinery is not regarded as part of the cost of the period; Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes.

Learn why depreciation is an estimated expense that does. This gives a more realistic picture of what your assets are worth. The cost for each year you own the asset becomes a. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Thus, depreciation is a process of allocation and not valuation. Here are the different depreciation methods and how. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. How does depreciation affect my balance sheet? Instead, it is shown as.

Here are the different depreciation methods and how. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Thus, depreciation is a process of allocation and not valuation. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. This gives a more realistic picture of what your assets are worth. How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The expenditure on the purchase of machinery is not regarded as part of the cost of the period; The cost for each year you own the asset becomes a. Learn why depreciation is an estimated expense that does.

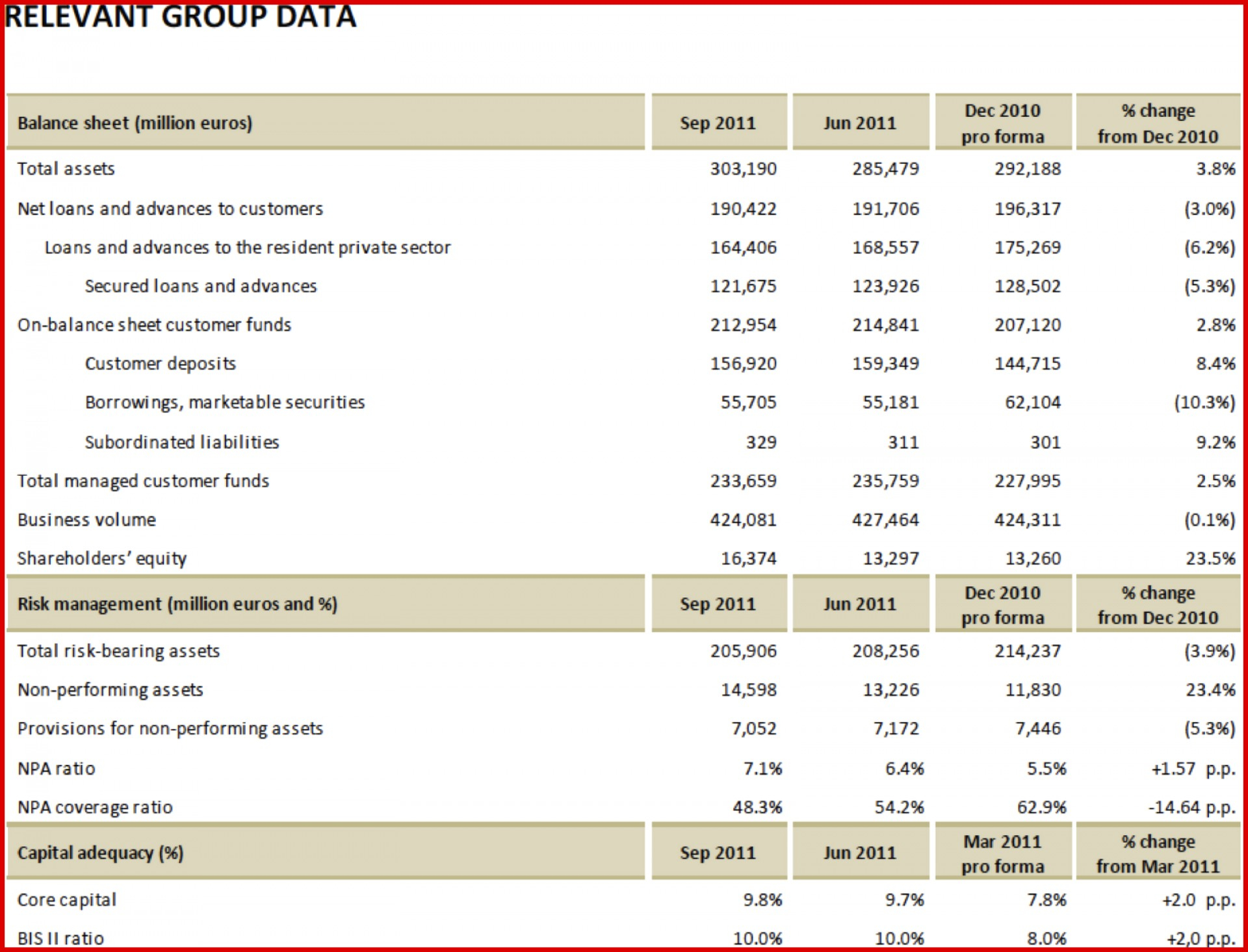

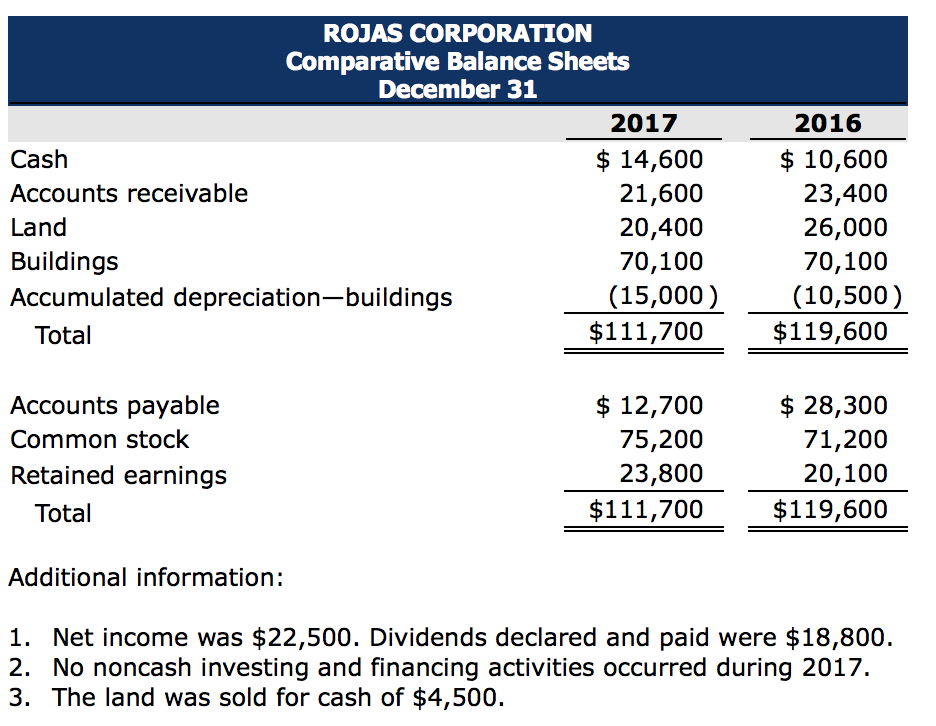

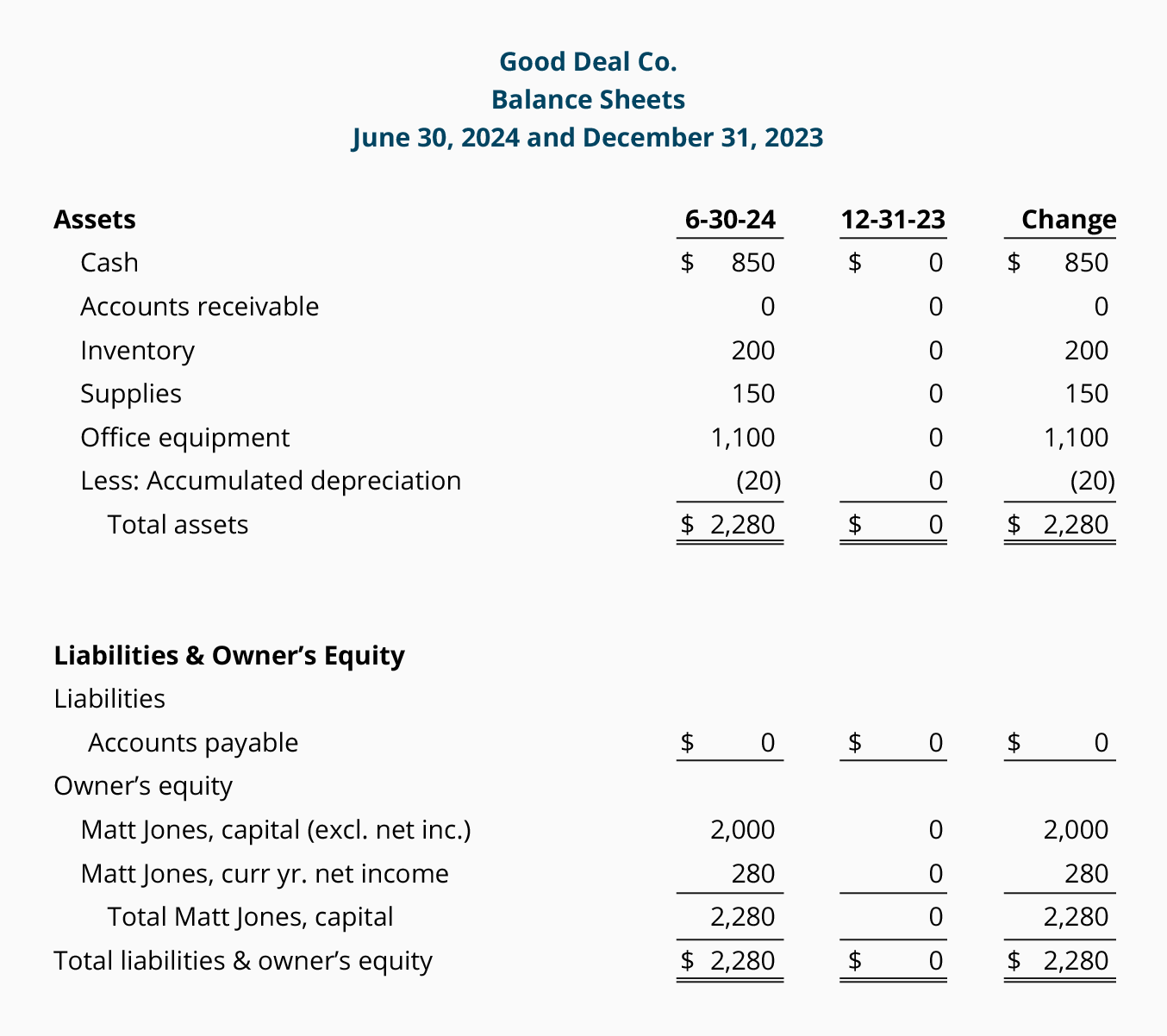

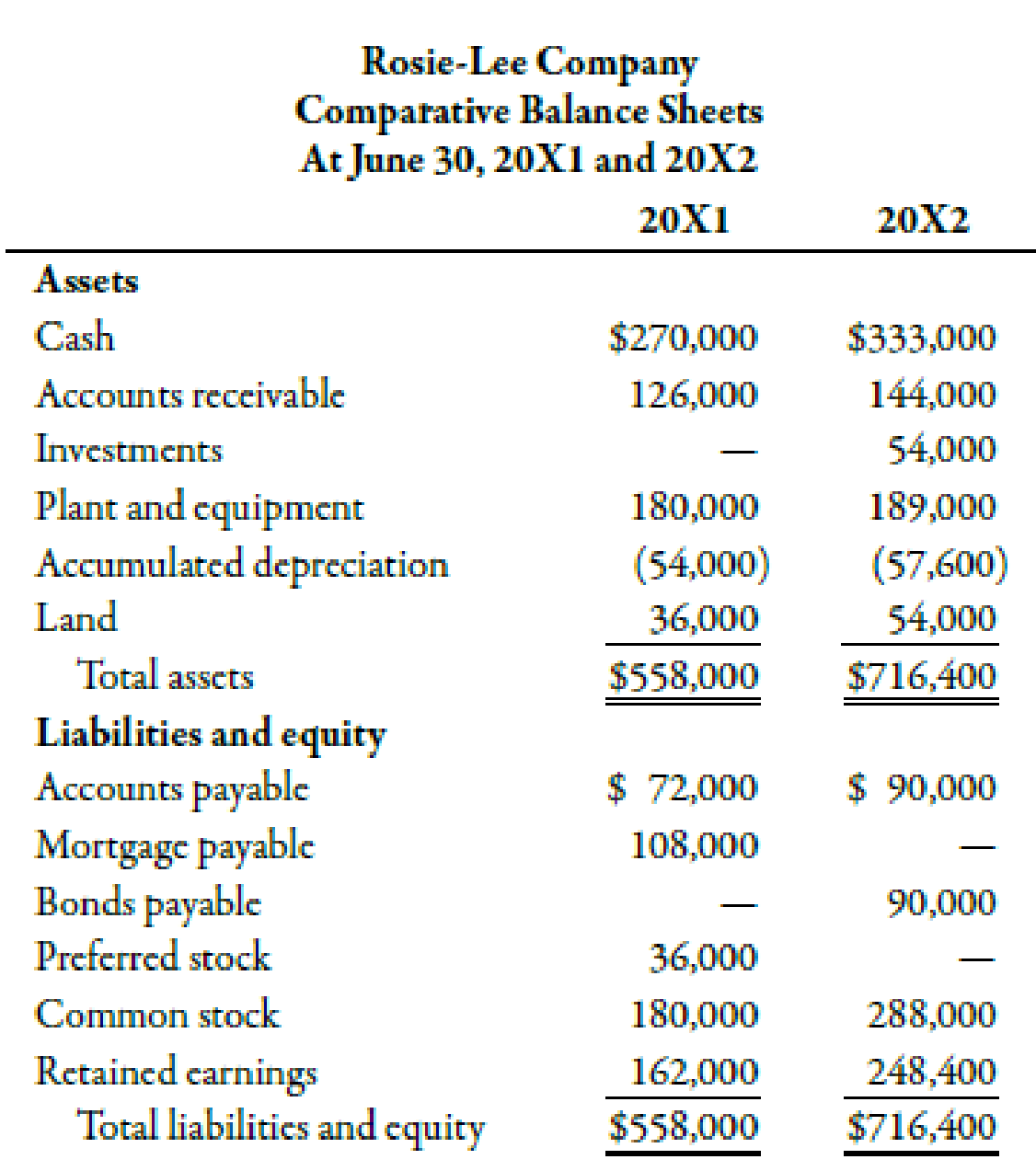

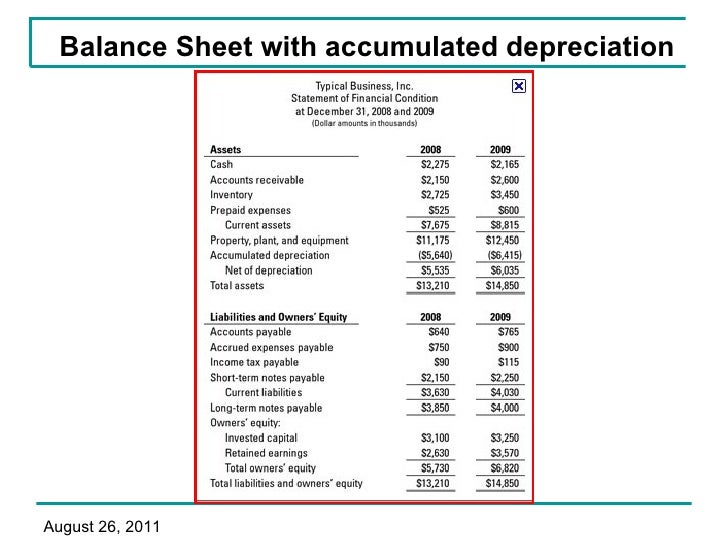

Balance Sheet Example With Depreciation

Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. How does depreciation affect my balance sheet? Instead, it is shown as. The cost for each year you.

How is accumulated depreciation on a balance sheet? Leia aqui Is

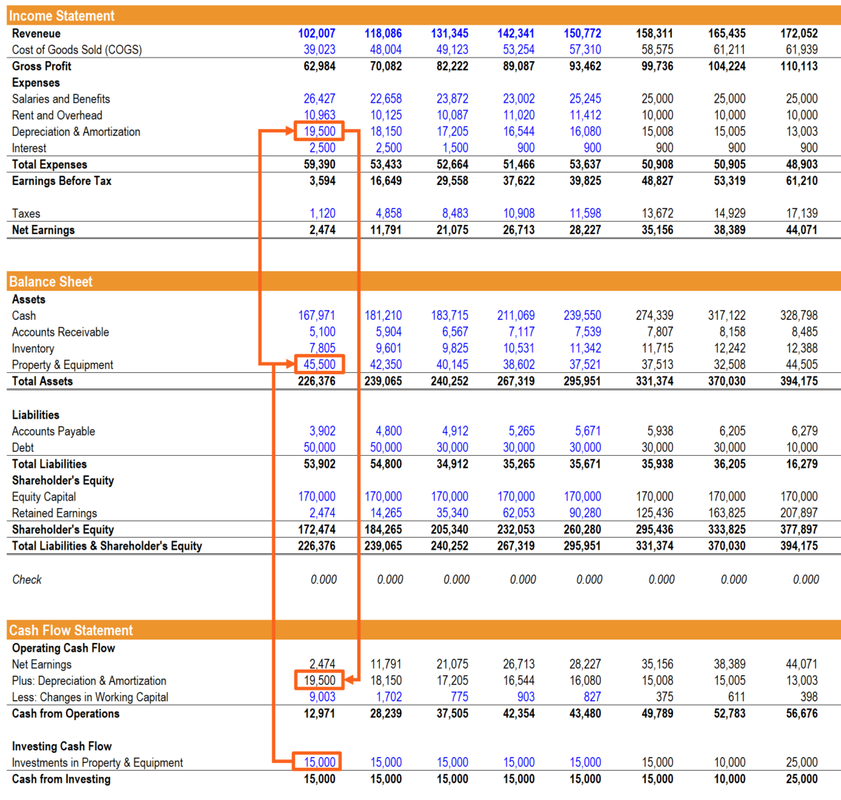

Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Here are the different depreciation methods and how. The expenditure on the purchase of machinery is not regarded as part of the cost of the period; Instead, it is shown as. How does depreciation affect my balance sheet?

Where Is Accumulated Depreciation on the Balance Sheet?

Here are the different depreciation methods and how. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Learn why depreciation is an estimated expense that does. This.

Balance Sheet Example With Depreciation

Thus, depreciation is a process of allocation and not valuation. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Learn why depreciation is an estimated expense that does. How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on.

Accumulated Depreciation On Balance Sheet Pictures to Pin on Pinterest

Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. How does depreciation affect my balance sheet? Thus, depreciation is a process of allocation and not valuation. The cost for each year you own the asset becomes a. Our explanation of depreciation emphasizes what the depreciation amounts on the.

Accumulated Depreciation Overview, How it Works, Example

Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Learn.

Balance Sheet Example With Depreciation

Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Here are the different depreciation methods and how. It lowers the value of your assets through accumulated depreciation. The expenditure on the.

Why is accumulated depreciation a credit balance?

Learn why depreciation is an estimated expense that does. Here are the different depreciation methods and how. How does depreciation affect my balance sheet? The expenditure on the purchase of machinery is not regarded as part of the cost of the period; It lowers the value of your assets through accumulated depreciation.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

Learn why depreciation is an estimated expense that does. It lowers the value of your assets through accumulated depreciation. Thus, depreciation is a process of allocation and not valuation. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. This gives a more realistic picture of what your assets.

How do you account for depreciation on a balance sheet? Leia aqui Is

The expenditure on the purchase of machinery is not regarded as part of the cost of the period; Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. This gives a more realistic picture of what your assets are worth. Here are the different depreciation methods and how. Our.

Here Are The Different Depreciation Methods And How.

Thus, depreciation is a process of allocation and not valuation. The expenditure on the purchase of machinery is not regarded as part of the cost of the period; Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Learn why depreciation is an estimated expense that does.

This Gives A More Realistic Picture Of What Your Assets Are Worth.

How does depreciation affect my balance sheet? The cost for each year you own the asset becomes a. It lowers the value of your assets through accumulated depreciation. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent.

Accumulated Depreciation Is The Total Decrease In The Value Of An Asset On The Balance Sheet Of A Business Over Time.

Instead, it is shown as.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)