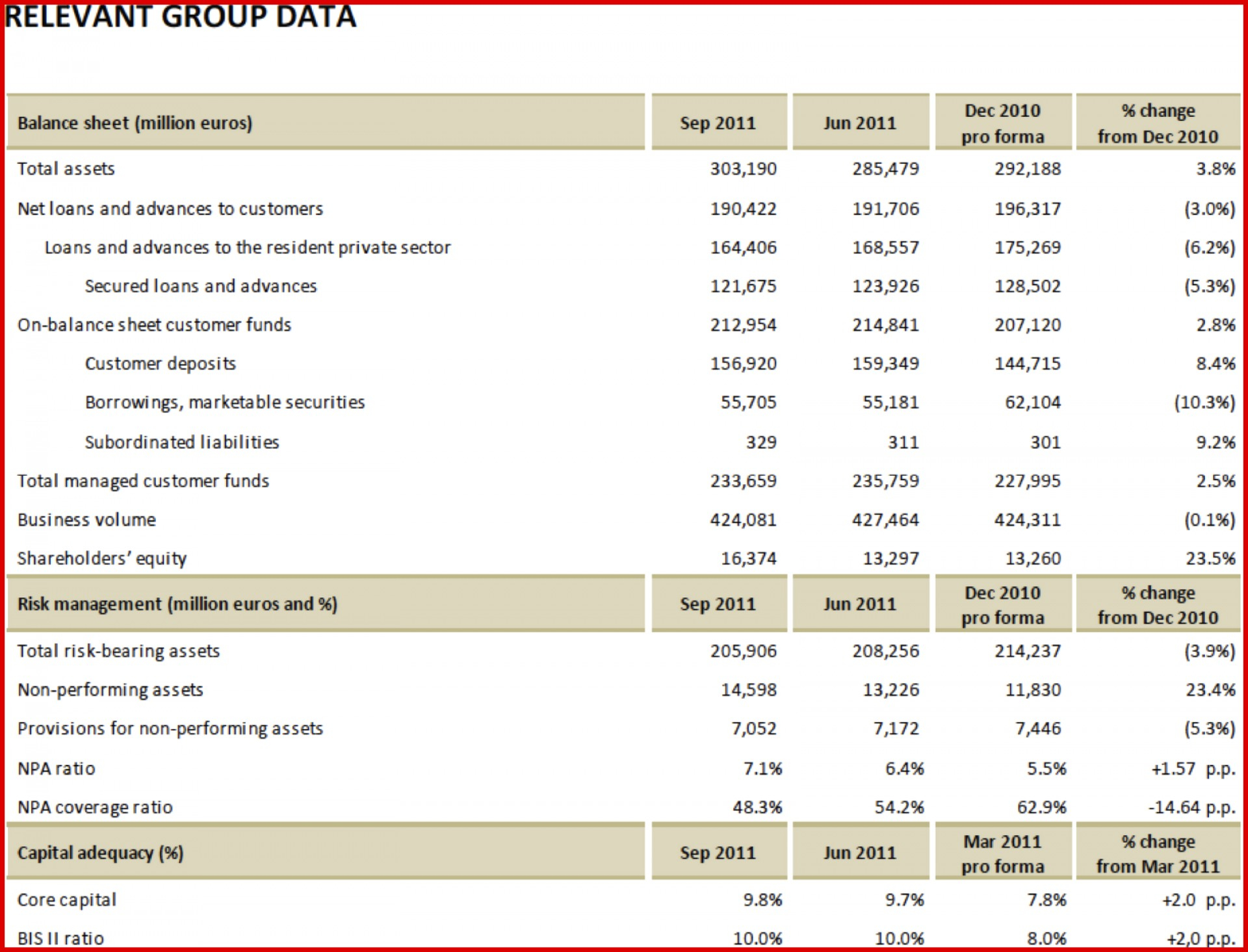

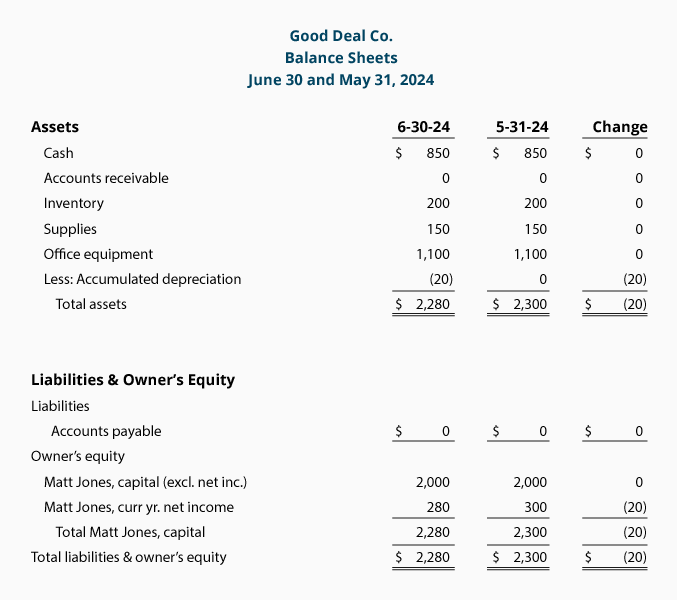

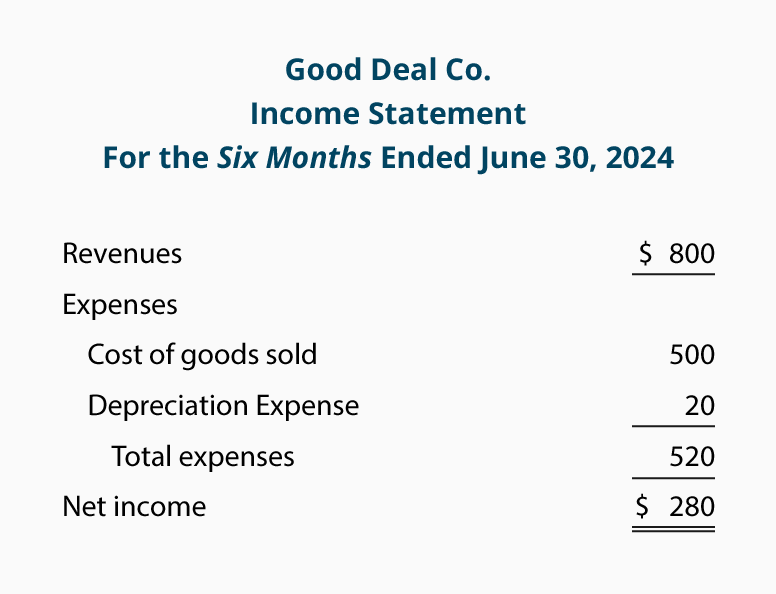

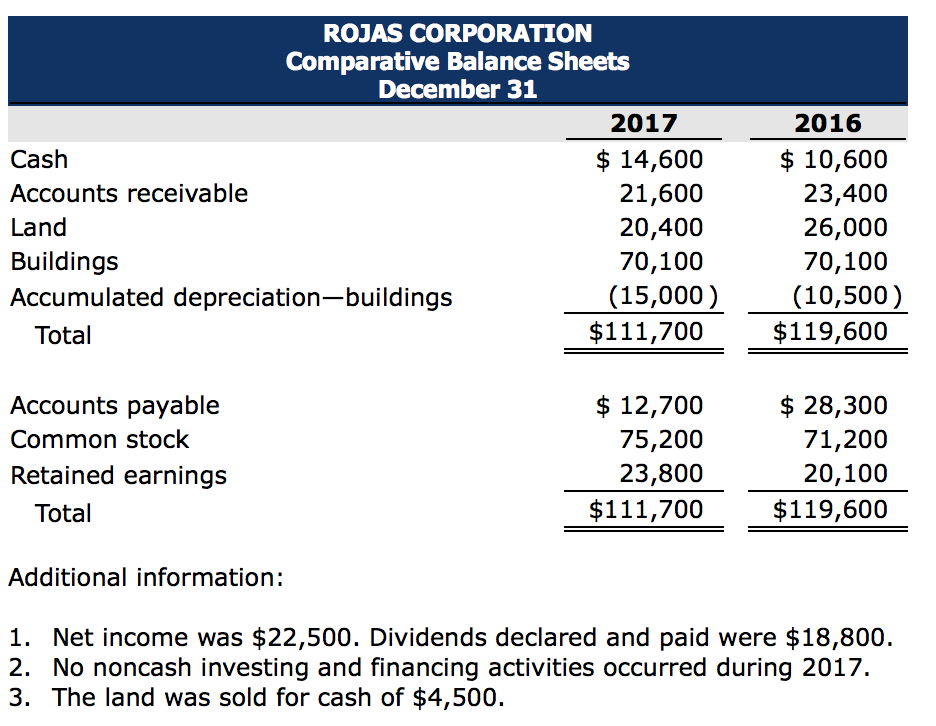

Depreciation Expense On Balance Sheet - Depreciation expense is reported on the income statement along with other normal business expenses. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Gain insights into where depreciation expense is recorded with our comprehensive. Discover the role of depreciation expense in a balance sheet and its impact on finance. Accumulated depreciation is listed on the balance sheet. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation.

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Discover the role of depreciation expense in a balance sheet and its impact on finance. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Accumulated depreciation is listed on the balance sheet. Gain insights into where depreciation expense is recorded with our comprehensive. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Depreciation expense is reported on the income statement along with other normal business expenses.

Accumulated depreciation is listed on the balance sheet. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Discover the role of depreciation expense in a balance sheet and its impact on finance. Depreciation expense is reported on the income statement along with other normal business expenses. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked).

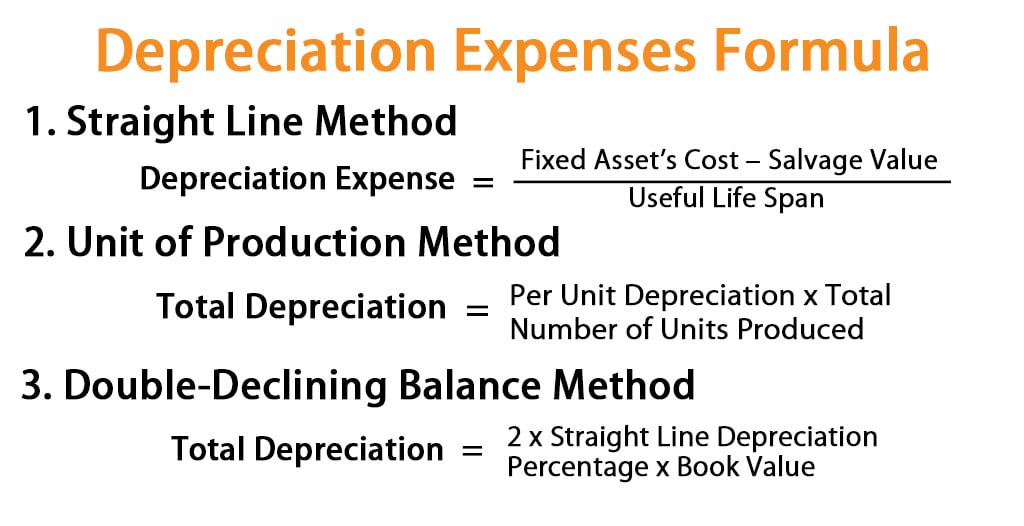

Describing the Depreciation Methods Used in the Financial Statements

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. Discover the role of depreciation expense in.

Why is accumulated depreciation a credit balance?

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. Gain insights into where depreciation expense is recorded with our comprehensive. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a.

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

Gain insights into where depreciation expense is recorded with our comprehensive. Accumulated depreciation is listed on the balance sheet. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. It is important to understand that the main purpose of depreciation is to move the cost of an.

Depreciation Expense Depreciation AccountingCoach

Gain insights into where depreciation expense is recorded with our comprehensive. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Accumulated depreciation is listed on the balance sheet. Depreciation moves these costs from the company's balance sheet (where.

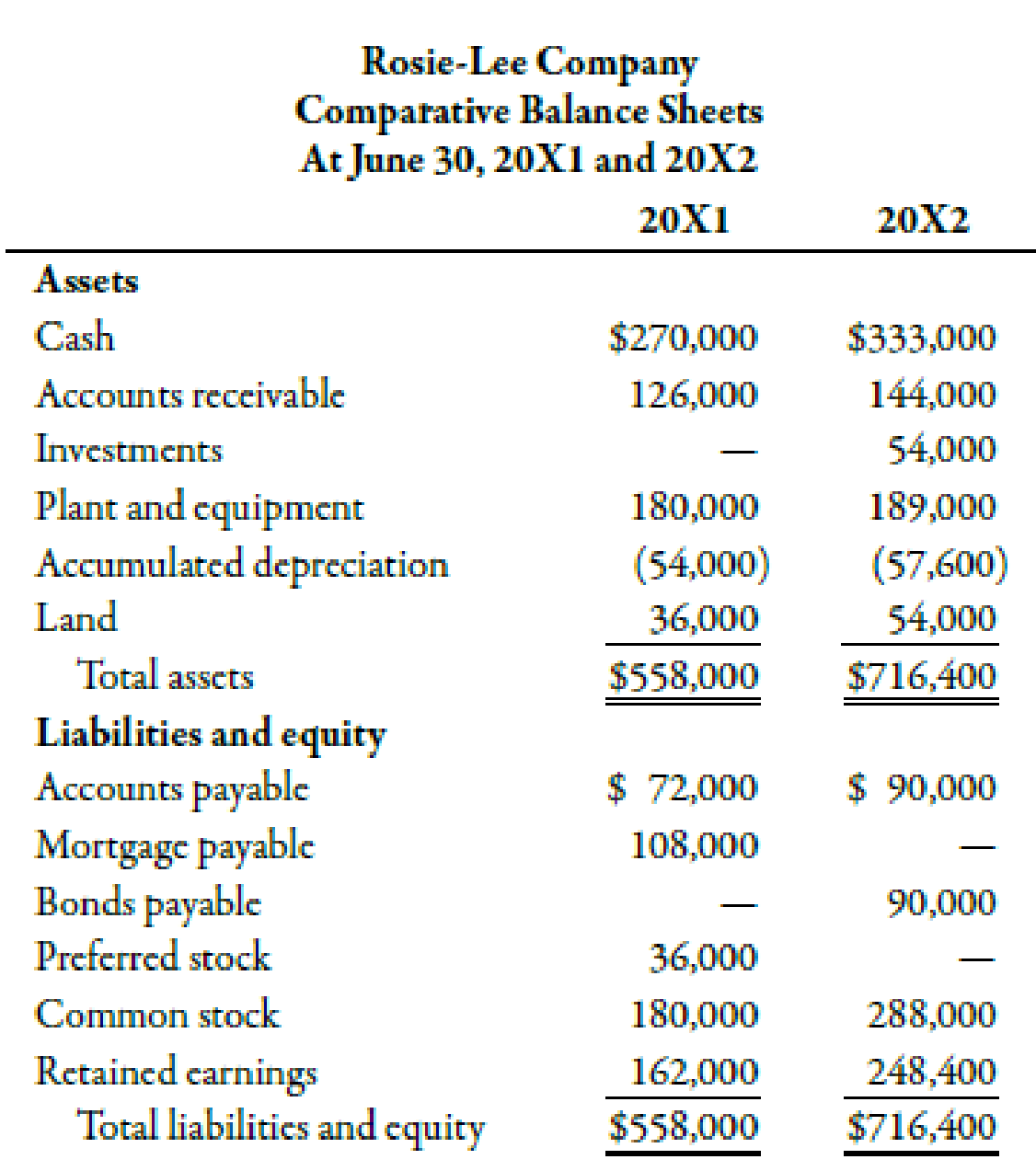

Balance Sheet Example With Depreciation

Gain insights into where depreciation expense is recorded with our comprehensive. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a.

How do you account for depreciation on a balance sheet? Leia aqui Is

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Accumulated depreciation is listed on the balance sheet. Gain insights into where depreciation expense is recorded with our comprehensive. Depreciation moves these costs from the company's balance sheet (where.

Balance Sheet Depreciation Understanding Depreciation

Discover the role of depreciation expense in a balance sheet and its impact on finance. Gain insights into where depreciation expense is recorded with our comprehensive. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Accumulated depreciation is.

Balance Sheet Example With Depreciation

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its.

Depreciation Expenses Formula Examples with Excel Template

Depreciation expense is reported on the income statement along with other normal business expenses. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life. It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage.

How is accumulated depreciation on a balance sheet? Leia aqui Is

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where expenses are tracked). Depreciation expense is reported on the income statement along with other normal business expenses. Gain insights into where depreciation expense is recorded with our comprehensive. It is important to understand that the main purpose of depreciation is to move.

Depreciation Expense Is Reported On The Income Statement Along With Other Normal Business Expenses.

It is important to understand that the main purpose of depreciation is to move the cost of an asset (except the estimated salvage value) from a company’s balance sheet to depreciation. Accumulated depreciation is listed on the balance sheet. Gain insights into where depreciation expense is recorded with our comprehensive. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its estimated useful life.

Depreciation Moves These Costs From The Company's Balance Sheet (Where Assets Are Recorded) To Its Income Statement (Where Expenses Are Tracked).

Discover the role of depreciation expense in a balance sheet and its impact on finance.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)