Bad Debt Expense Balance Sheet - The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

Recording bad debt involves a debit and a credit entry. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense.

Recording bad debt involves a debit and a credit entry. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense.

Bad Debt Expense Definition and Methods for Estimating

A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry.

What are Bad Debts (Example, Journal Entry)? Accounting Capital

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

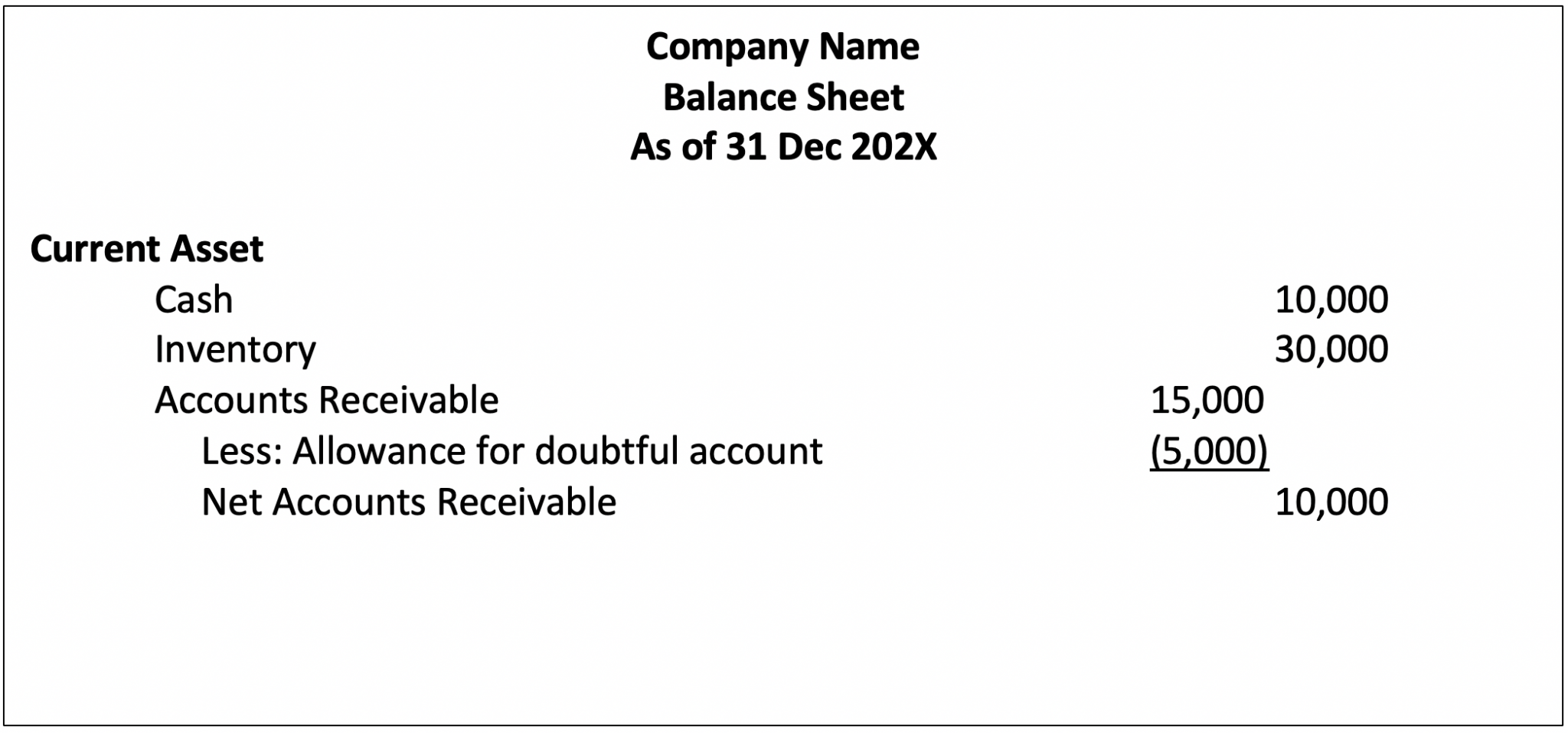

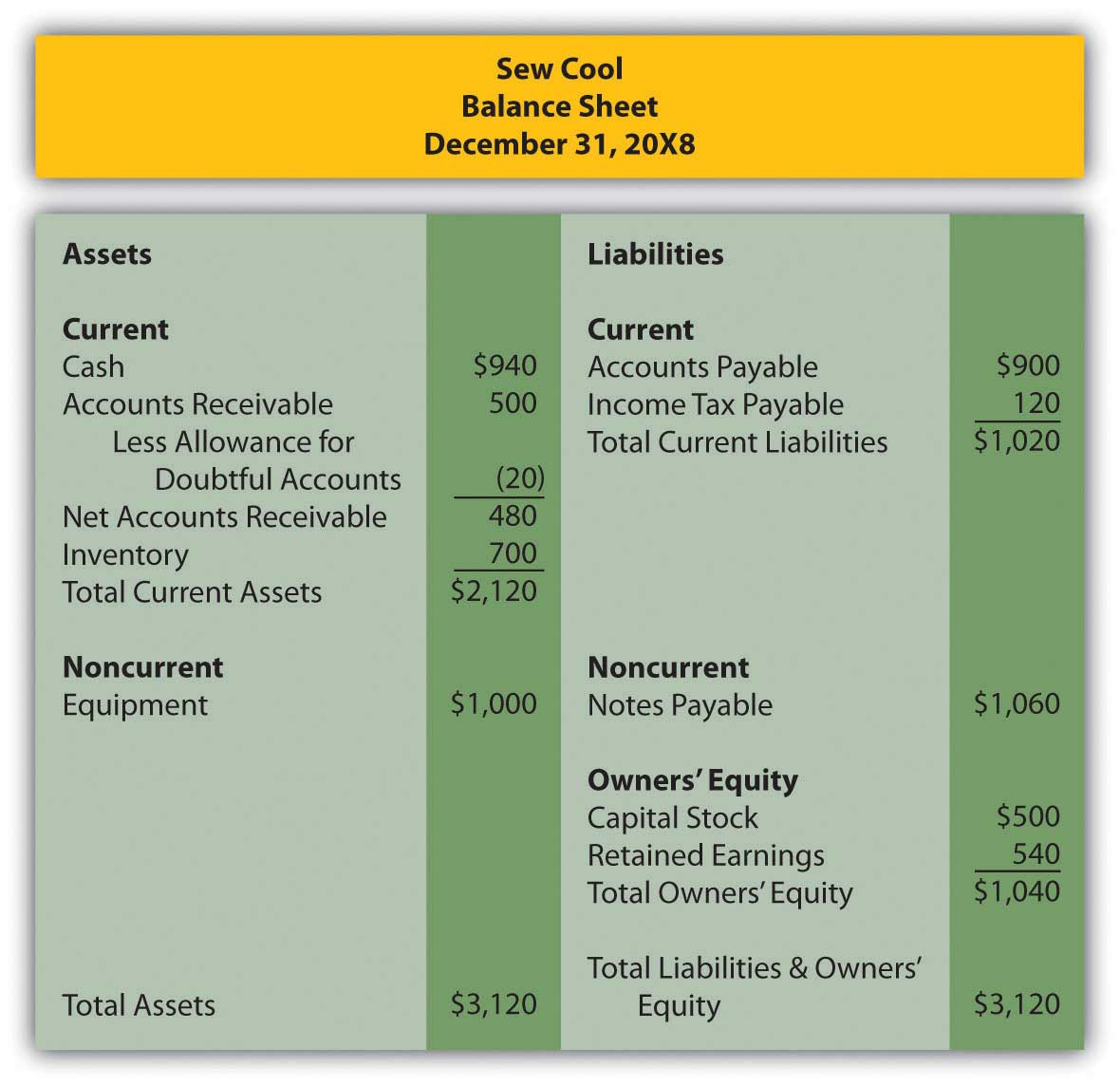

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

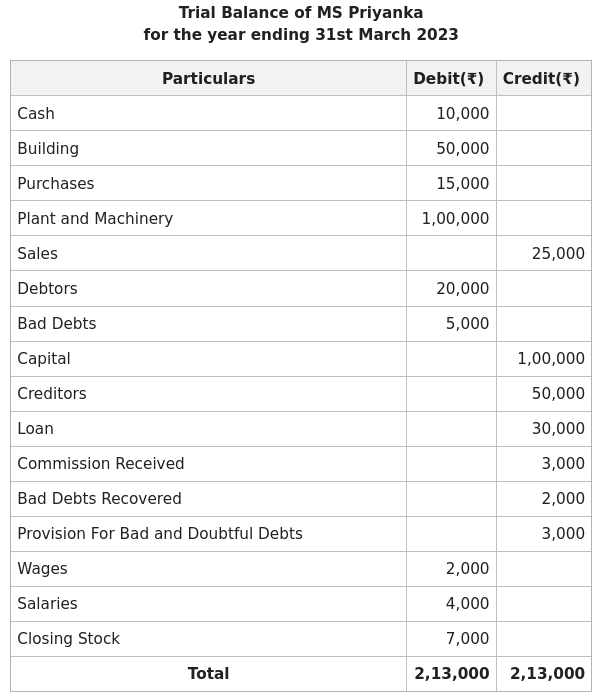

Adjustment of Bad Debts Recovered in Final Accounts (Financial

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

321 07 Bad Debt Expense Balance Sheet Approach YouTube

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

How to Show Bad Debts in Balance Sheet?

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

How to calculate and record the bad debt expense QuickBooks Australia

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

Allowance For Bad Debts

A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry.

The Bad Debt Expense Is A Company’s Outstanding Receivables That Were Determined To Be Uncollectible And Are Thereby.

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)